ECOM6013 E-Commerce Technologies

Topic 7 E-Payment Systems

Payment System Stakeholders’ Priorities

- Customer

- Low-risk

- Low-cost

- Refutable

- Convenience

- Reliable

- Merchants

- Low-risks

- Low-cost

- Irrefutable

- Secure

- Reliable

- Financial intermediaries

- Secure

- Low-risk

- Maximizing profit

- Government regulators

- Secure

- Trust

- Protecting participants and enforcing reporting

Type of Payment Systems

- Cash

- Cheque transfer

- Credit card

- Stored value

- Accumulating balance

B2C Payment System

- Credit cards

- Financial cybermediaries

- Electronic bill presentment and payment

- Smart cards

- Mobile payment

Features

- Make large purchases

- Will not pay with credit card or financial cybermediary

- Use financial EDI (Electronic Data Interchange)

- Pay for many purchases at once

- Likely that cloud-based payment gateway (or other Internet-based technology) will eventually take over completely!

- FPS - HKMA & HKICL Payment Gateway Faster Payment System (FPS)

E-Commere Payment Systems

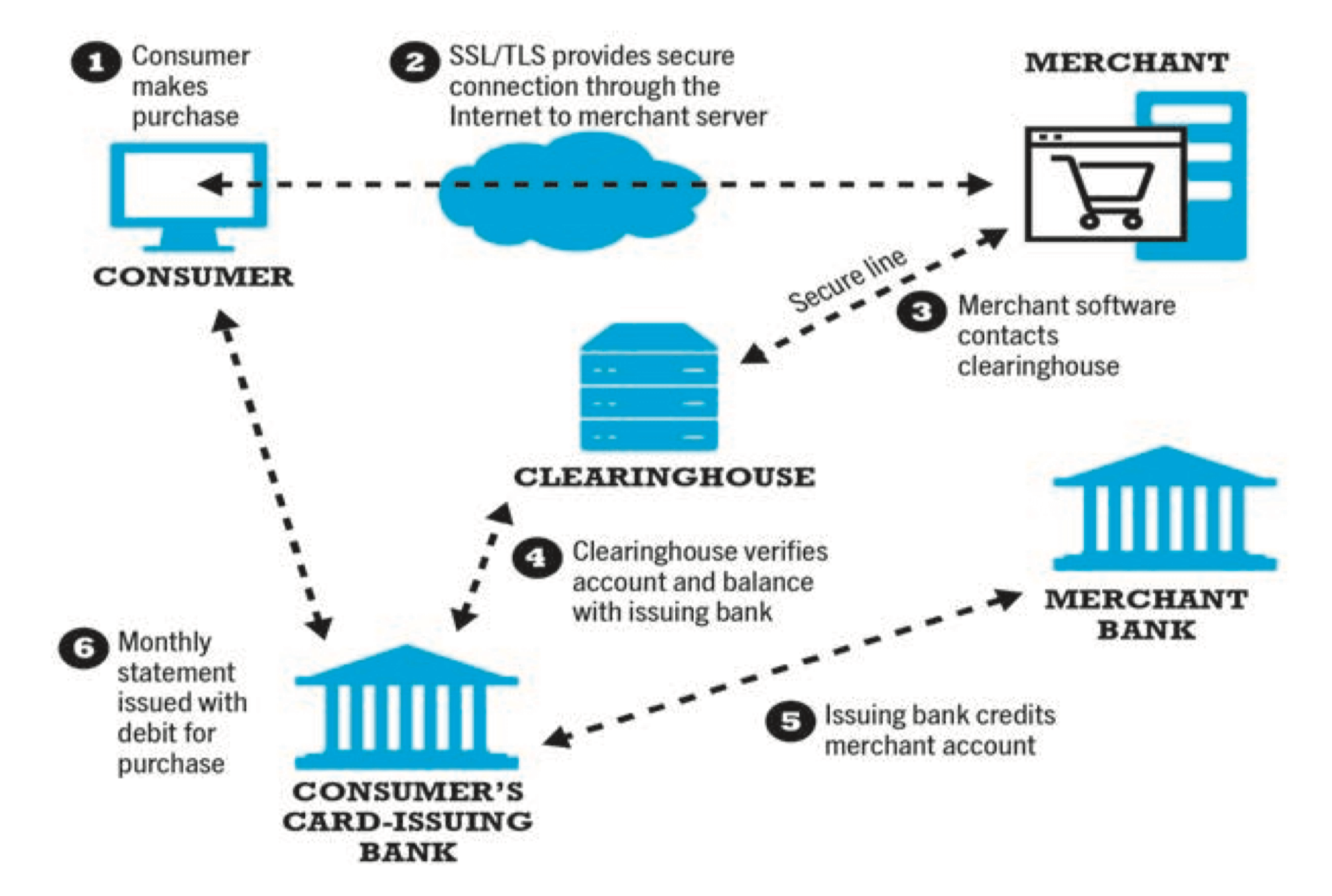

- Credit cards

- Debit cards

- Digital wallets

- Digital cash

- Digital checking

- Online stored value systems

- PayPal, AliPay, WeChat Pay

- Smart cards

- Contact

- Contactless

- EZPass, Octopus card

- Radio Frequency ID (RFID)

- Near Field Communications (NFC)

Future Payment System

- Exporting existing payment systems that work in traditional commerce to E-Commerce causes problems

- Need a payment/financial system designed for the online world

- Cybercurrencies / digital currency

Related Posts

Comments